The UAE's Ministry of Finance has published new guidelines to help businesses transition into post-implementation of corporate tax.

Transitional Rules for Corporate Tax, issued by the Ministry of Finance, offers companies advice so they can start with accurate balance sheets as the tax is implemented.

Ministry Undersecretary, Younis Haji Al Khouri, says the guidelines are to ensure a fair and transparent gauging of assets and liabilities held prior to the implementation of the new corporate tax regime.

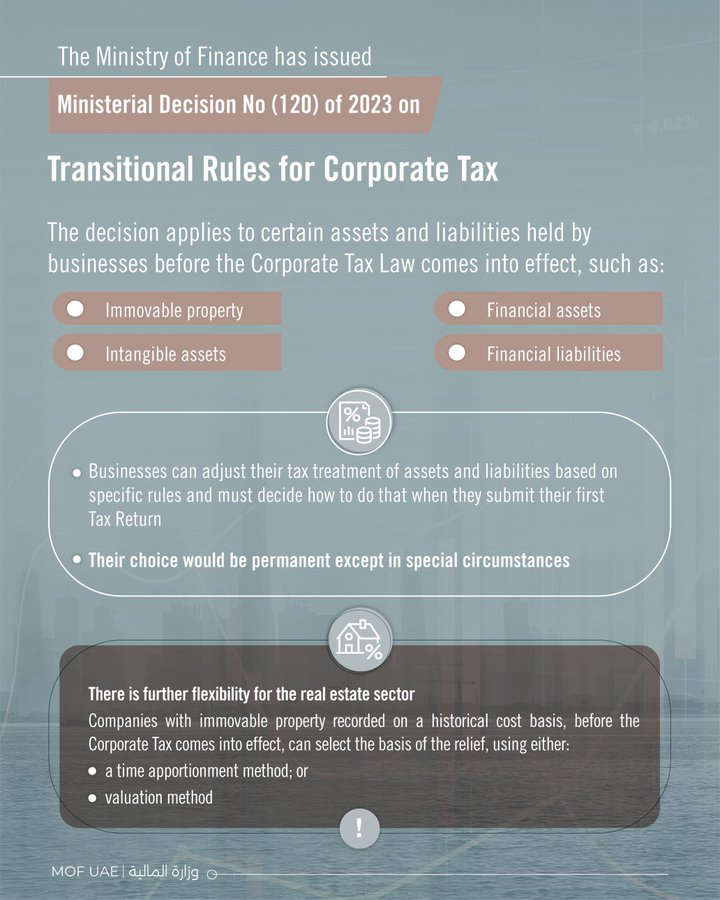

The guidelines apply to certain assets and liabilities, such as immovable property, intangible assets, financial assets and financial liabilities, held by businesses before the law comes into effect.

Businesses can adjust their tax treatment of such assets and liabilities based on specific rules and must decide how to do that when they submit their first tax return, and their choice will be permanent except in special circumstances.

The decision also considers the ownership history of assets and liabilities, including those owned by the company or other members of the same business group.

There is further flexibility for the real estate sector where companies with immovable property recorded on a historical cost basis have an option to select the basis of the relief, using either a time apportionment method or valuation method, thereby allowing groups to determine the most favourable outcome for them on immovable property on an asset-by-asset basis.

For example, consider a UAE company that owns a real property asset, such as a building or land, before the effective date of the Corporate Tax Law. Upon selling the property after the enactment of the law, the company can choose one of two methods for adjusting their Taxable Income - they can either exclude a portion of the gain based on the property's holding period, or they can use a fixed formula based on the property's value (as determined by the relevant government entities in charge of valuation of land and real-estate property in the UAE) at the start of the first tax period.

This ensures a fair tax calculation that considers the property's ownership or value history and only taxes that business' gains on such immovable property that are attributed to periods after the corporate tax is levied.

Another possible scenario for financial assets and liabilities would be a local business that holds shares in another company recorded on a historical cost basis before the implementation of corporate tax.

When this local business sells these shares after the law comes into effect, it can adjust its Taxable Income by excluding a portion of the gain based on the shares' value at the start of the first tax period.

This transitional rule ensures only gains of that business on such shares that are attributed to periods after the law is effective are taxed.

UAE ranks third globally in sovereign wealth assets

UAE ranks third globally in sovereign wealth assets

OPEC+ speeds up oil output hikes, adds 548,000 bpd in August

OPEC+ speeds up oil output hikes, adds 548,000 bpd in August

UAE emerges as global base for digital nomads

UAE emerges as global base for digital nomads

French air traffic controllers' walkout disrupts early summer travel

French air traffic controllers' walkout disrupts early summer travel

Non-oil sector fuels 3.4% GDP growth in Abu Dhabi

Non-oil sector fuels 3.4% GDP growth in Abu Dhabi