The UAE and South Korea have discussed the prospect of pursuing a Comprehensive Economic Partnership Agreement (CEPA) to strengthen economic ties, enhance investment opportunities and mark a new era of bilateral cooperation.

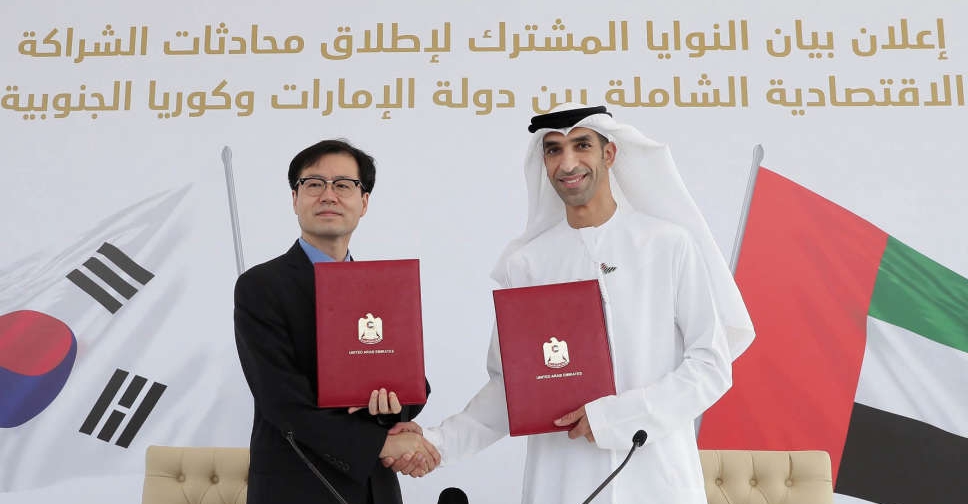

This came during a meeting between Dr. Thani bin Ahmed Al Zeyoudi, Minister of State for Foreign Trade, and a high-level Korean delegation, headed by Yeo Han-Koo, South Korea's Minister for Trade.

The UAE has already started negotiations on two such deals, following the launch of talks with India and Indonesia in September.

It underscores the country’s ambition to move fast by striking new trade agreements with high-growth markets in Africa and Asia under a clear social and economic strategy for the next 50 years.

"We are working around the clock to consolidate the UAE’s position as a global trade and logistics hub that connects the world to the broader region and beyond," Dr. Al Zeyoudi said.

"The CEPA would serve as a leverage to further expand bilateral trade and investment. And it would intensify future-oriented cooperation between the two countries and serve as a framework for achieving more concrete outcomes from our bilateral collaboration," Yeo Han-Koo told news agency WAM.

The CEPA negotiation process is set to begin soon, covering a variety of issues, including market access to goods and services, as well as e-commerce and achieving carbon neutrality.

The UAE is South Korea’s largest trading partner in the Arab world, with bilateral trade exchange valued at US$9.4 billion in 2020.

Non-oil trade in the first six months of 2021 has grown to US$2.1 billion.

In recent years, foreign direct investment has focused on strategically important national industries, such as renewable and nuclear energy, hydrocarbons, healthcare and logistics.

Prominent projects include the US$20 billion Barakah Nuclear Power Plant in Abu Dhabi, with construction led by Korea Electric Power Corporation in a consortium that also includes Hyundai, Samsung, Korea Hydro & Nuclear Power and Doosan Heavy Industries and Construction.

Earlier this year, Mubadala was part of a consortium that acquired a majority stake in Korean cosmetic pharmaceutical company Hugel for US$1.5 billion.

In 2020, Korea’s NH Investment & Securities joined a group of asset management and sovereign wealth funds to invest US$20.7 billion in Abu Dhabi National Oil Company’s midstream assets.

OPEC+ speeds up oil output hikes, adds 548,000 bpd in August

OPEC+ speeds up oil output hikes, adds 548,000 bpd in August

French air traffic controllers' walkout disrupts early summer travel

French air traffic controllers' walkout disrupts early summer travel

Non-oil sector fuels 3.4% GDP growth in Abu Dhabi

Non-oil sector fuels 3.4% GDP growth in Abu Dhabi

Dubai launches initiative to assist first-time home buyers

Dubai launches initiative to assist first-time home buyers

Archer Aviation conducts electric flying taxi test flight in Abu Dhabi

Archer Aviation conducts electric flying taxi test flight in Abu Dhabi