Dubai's TECOM Group has debuted on the Dubai Financial Market (DFM) successfully.

The IPO was 21 times oversubscribed with total gross demand surpassing AED 35.4 billion.

The final offer price was set at AED 2.67 per share, giving it a valuation of AED 13.4 billion.

Speaking exclusively to ARN News, Abdulla Belhoul, CEO of Tecom Group says it's an important milestone for Dubai and the group, and gave details of the demand for the share offering.

UAE, Montenegro to develop renewable projects under new partnership

UAE, Montenegro to develop renewable projects under new partnership

UAE joins US-led Pax Silica initiative to bolster technology supply chain

UAE joins US-led Pax Silica initiative to bolster technology supply chain

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

Netflix prepares all-cash offer for Warner Bros, source says

Netflix prepares all-cash offer for Warner Bros, source says

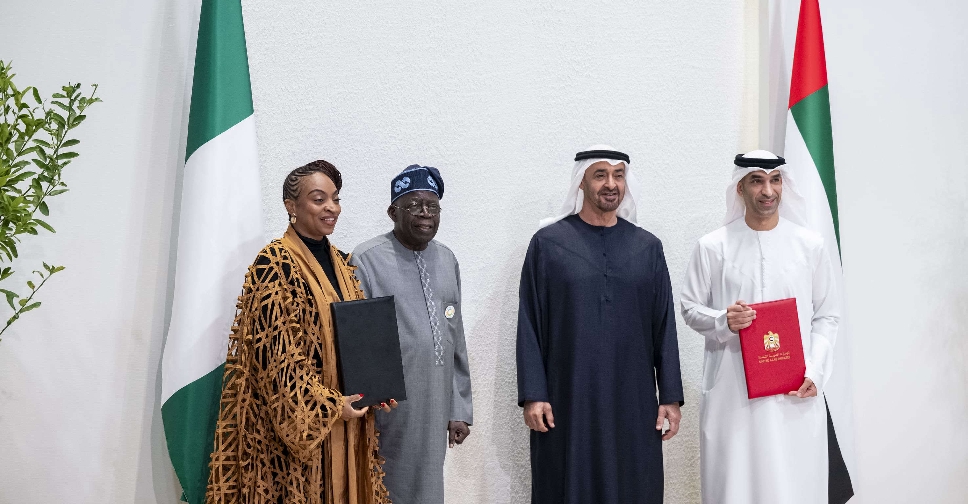

UAE, Nigeria sign comprehensive economic partnership agreement

UAE, Nigeria sign comprehensive economic partnership agreement