The results of the second auction of the UAE Treasury Bonds programme (T-Bonds), represented by the Ministry of Finance (MoF) as the issuer, in collaboration with the Central Bank of the UAE (CBUAE) as the issuing and payment agent, have been announced.

The Monday auction witnessed strong demand through the six primary bank dealers, with bids received worth AED 9.7 billion, and an oversubscription by 6.5 times.

The strong demand was across both tranches with a final allocation of AED 750 million for the 2 year tranche and AED 750 million for the 3 year tranche, with a total of AED 1.5 billion issued in the second auction.

The success is reflected in the attractive market driven prices, which was achieved by a spread of a 27 bps over US Treasuries for two years, and a spread of 25 bps over US Treasuries for 3 years. The second auction followed the practice of re-opening the T-Bonds which helps in building up the size of individual bond issues over time and improve liquidity in the secondary market.

The T-Bonds programme will contribute in building the UAE dirham denominated yield curve, providing safe investment alternatives for investors, strengthening the local debt capital market, developing the investment environment, as well as supporting sustainable economic growth.

The auction is part of the AED9 billion T-Bond issuance programme for 2022 as published in the T-Bonds calendar earlier this year.

#وزارة_المالية: المزاد الثاني لسندات الخزينة يواصل تحقيق نتائج استثنائية.#وام_اقتصاد https://t.co/1nRYMB3Cn0 pic.twitter.com/q2Cwbf86v2

— وام الاقتصادية (@BusinessWam) June 20, 2022

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

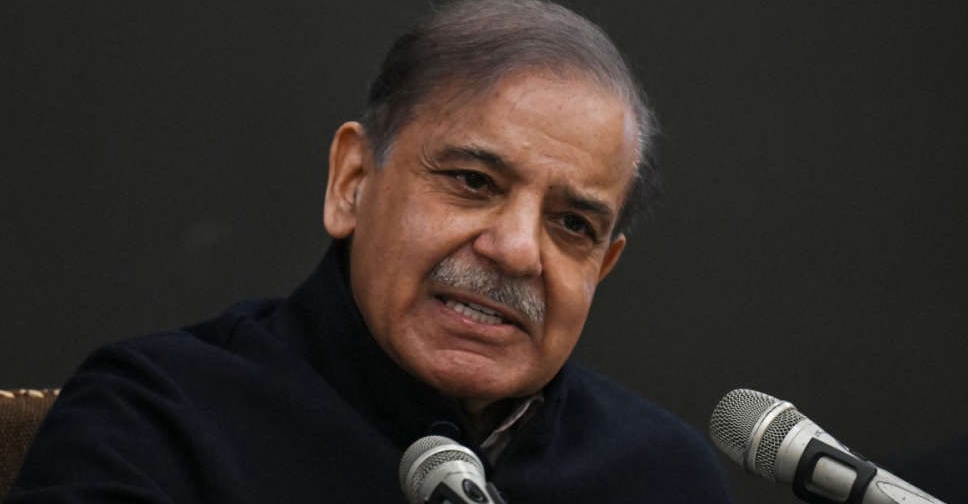

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif