When Organisation of Petroleum Exporting Countries (OPEC) and Russia meet this weekend to gauge progress on their oil-supply deal, they will be trying to dispel the shadow of previous unfulfilled promises. Oil prices rose 20 per cent in the month after OPEC agreed to cut output, reaching $54.06 a barrel in New York on December 28. Since then, they have slipped almost 5 per cent as traders, with one eye on rising US shale production, await proof that OPEC and other producers will live up to their deal. They recall how Russia broke its pledge during cutbacks in 2008, while some members of the producers group failed to fully implement the agreement. The solution: The dealmakers have created a panel to verify the cuts, a five-nation group with both OPEC and non-OPEC members that will meet January 22 in Vienna. While some see this as an impressive indication of intent in the midst of a two-year price rout, others worry the group is only now trying to establish how compliance will be assessed. (Grant Smith/Bloomberg)

UAE, Montenegro to develop renewable projects under new partnership

UAE, Montenegro to develop renewable projects under new partnership

UAE joins US-led Pax Silica initiative to bolster technology supply chain

UAE joins US-led Pax Silica initiative to bolster technology supply chain

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

Netflix prepares all-cash offer for Warner Bros, source says

Netflix prepares all-cash offer for Warner Bros, source says

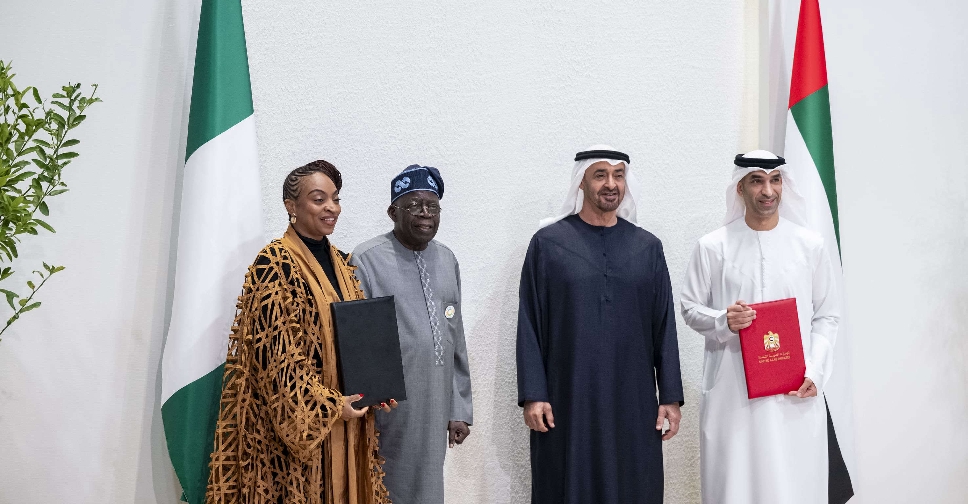

UAE, Nigeria sign comprehensive economic partnership agreement

UAE, Nigeria sign comprehensive economic partnership agreement