From Eni SpA to BP Plc, the biggest international oil companies are reining in capital spending for 2017 and possibly longer as they try to squeeze profits from a crude market battered by a global glut. Eni, which posted a greater-than-expected third-quarter loss, is reducing capital expenditure at least through next year, CEO Claudio Descalzi said in a Bloomberg TV interview from Abu Dhabi, where energy companies are meeting to discuss the industry’s future. BP is holding outlays to about $16 billion this year compared with a previous estimate of less than $17 billion, its CEO Bob Dudley said in a separate interview at the conference. Many other companies in the industry were doing the same, “bolting” down their capital spending, he said Monday. Energy majors are putting limits on expenditures as OPEC, which agreed in September to trim output for the first time in eight years, struggles to persuade Russian and other producers from outside the group to join the cuts. OPEC, which pumps about 40 per cent of the world’s oil, wants to put the changes into effect when it meets in Vienna on November 30. (Manus Cranny, Anthony DiPaola, Sam Wilkin and Mahmoud Habboush/Bloomberg)

UAE, Montenegro to develop renewable projects under new partnership

UAE, Montenegro to develop renewable projects under new partnership

UAE joins US-led Pax Silica initiative to bolster technology supply chain

UAE joins US-led Pax Silica initiative to bolster technology supply chain

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

Netflix prepares all-cash offer for Warner Bros, source says

Netflix prepares all-cash offer for Warner Bros, source says

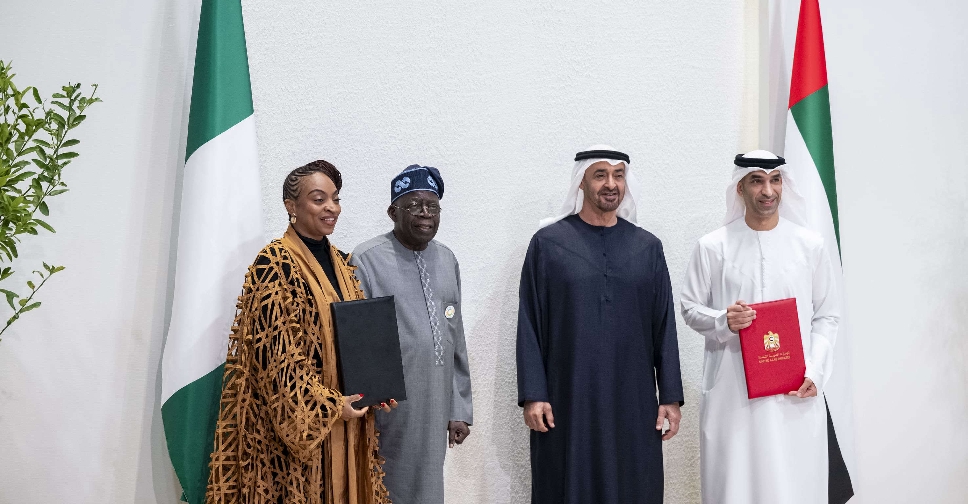

UAE, Nigeria sign comprehensive economic partnership agreement

UAE, Nigeria sign comprehensive economic partnership agreement