Dubai’s property market is on the uphill as "serious" buyers return to the market, observed Nakheel PJSC Chairman Ali Rashid Lootah, who is visiting Singapore to market Nakheel’s Palm 360 and Palm Tower projects to overseas investors. “Dubai is growing, we are seeing signs of more inquiries. The market is maturing, we are seeing more serious, cautious investors, not speculators,” he said. Real estate sales in the emirate fell almost 30 per cent by value in the first seven months of the year, according to data from the Dubai Land Department, as a slump in oil prices led to an economic slowdown in Gulf countries. Real estate analysts see either a flat market or a further slowdown in 2017 with Jesse Downs, managing director at real estate consultant Phidar Advisory predicting a 10 per cent drop in values after a 7 per cent slide this year. Nakheel’s largest share of buyers are from the GCC, namely Saudi Arabia, Kuwait and Qatar. The next largest group is Indians followed by the British. Investors looking for alternatives to UK property following the nation’s referendum to exit the EU may consider Dubai, Lootah said. About half of the 504 apartments in the 52-story hotel and residential Palm Tower have been sold since they went on sale two years ago. The building’s first 18 floors will be a luxury hotel operated under the St. Regis brand. (Pooja Thakur/Bloomberg)

UAE, Montenegro to develop renewable projects under new partnership

UAE, Montenegro to develop renewable projects under new partnership

UAE joins US-led Pax Silica initiative to bolster technology supply chain

UAE joins US-led Pax Silica initiative to bolster technology supply chain

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

Netflix prepares all-cash offer for Warner Bros, source says

Netflix prepares all-cash offer for Warner Bros, source says

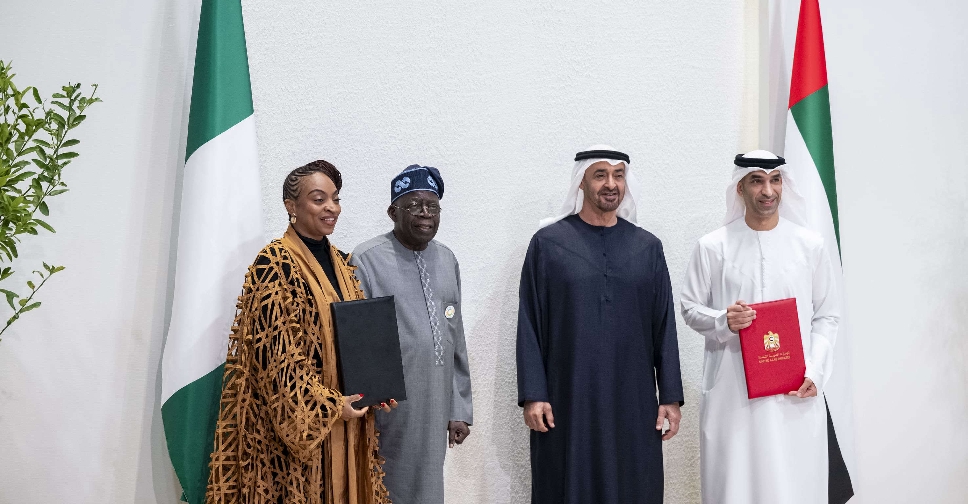

UAE, Nigeria sign comprehensive economic partnership agreement

UAE, Nigeria sign comprehensive economic partnership agreement