The European Commission has ruled that Ireland must recover up to AED 52 billion in back taxes from Apple. After a three year long investigation they concluded that the US firm’s tax benefits were illegal. The Commission said Apple was coughing up substantially less than other businesses, in effect paying a corporate tax rate of 1%. Ireland has responded saying they profoundly disagree with the ruling.

UAE, Montenegro to develop renewable projects under new partnership

UAE, Montenegro to develop renewable projects under new partnership

UAE joins US-led Pax Silica initiative to bolster technology supply chain

UAE joins US-led Pax Silica initiative to bolster technology supply chain

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

Netflix prepares all-cash offer for Warner Bros, source says

Netflix prepares all-cash offer for Warner Bros, source says

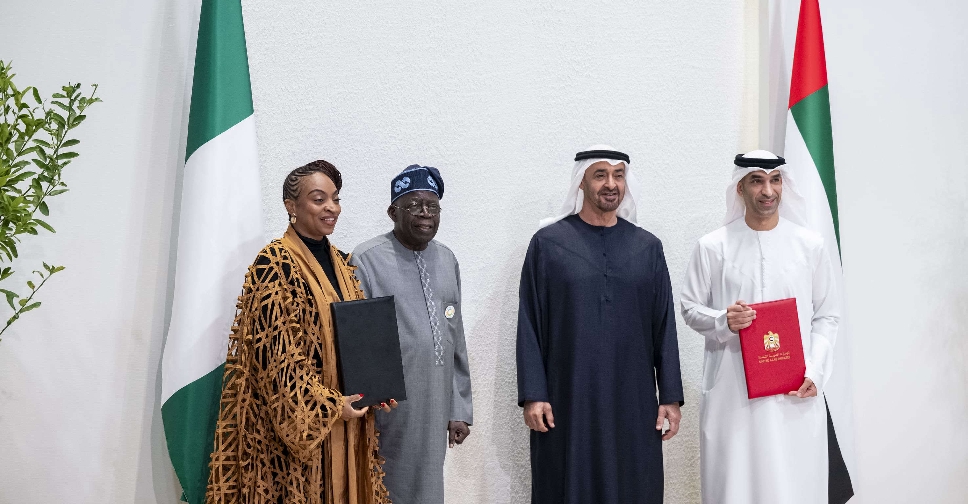

UAE, Nigeria sign comprehensive economic partnership agreement

UAE, Nigeria sign comprehensive economic partnership agreement