Abu Dhabi’s proposed merger of Mubadala and IPIC will create a global energy business worth nearly AED 500 billion, with an oil output bigger than Libya. Analysts say the union will create an integrated company that could both pump oil and process it into fuel and petrochemicals used to make consumer goods. His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi, Deputy Supreme Commander of the UAE Armed Forces and Chairman of the Abu Dhabi Executive Council, earlier issued a resolution to merge the investment bodies. The merger is part of a move of more consolidation in Abu Dhabi. “The combined entity will realise synergies and growth in multiple sectors including the energy and utilities sector, technology, aerospace, industry, healthcare, real estate and financial investments," according to national news agency WAM. “It will also have the ability to contribute more significantly to the diversification of the economy, in line with the Abu Dhabi Plan and the country’s long-term vision."

UAE, Montenegro to develop renewable projects under new partnership

UAE, Montenegro to develop renewable projects under new partnership

UAE joins US-led Pax Silica initiative to bolster technology supply chain

UAE joins US-led Pax Silica initiative to bolster technology supply chain

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

H.H. Sheikh Hamdan hails Dubai Chamber of Commerce growth milestone

Netflix prepares all-cash offer for Warner Bros, source says

Netflix prepares all-cash offer for Warner Bros, source says

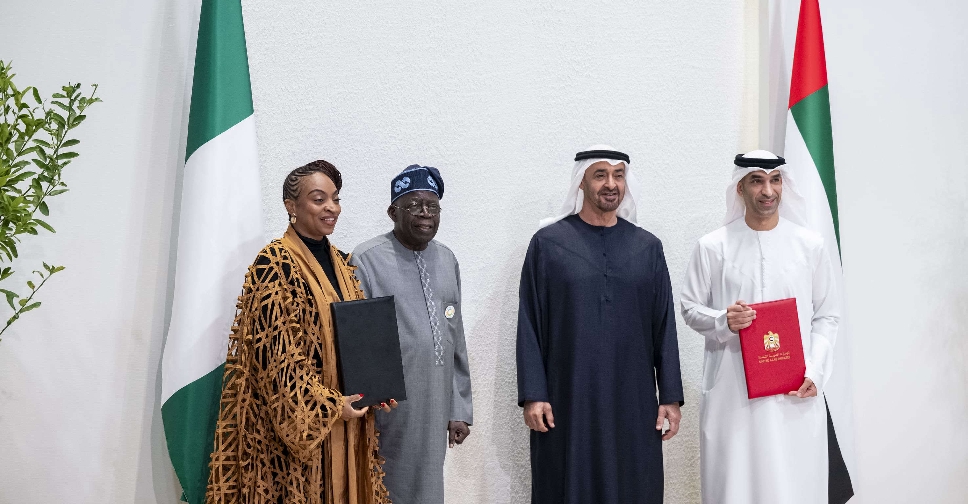

UAE, Nigeria sign comprehensive economic partnership agreement

UAE, Nigeria sign comprehensive economic partnership agreement