Dubai Financial Services Authority (DFSA) has fined Bank Mirabaud AED 11.1 million ($3.02 million) for failing to put in place adequate anti-money laundering (AML) systems and controls.

The lapses were recorded between June 2018 and October 2021.

The authority added that the initial fine of AED 14.32 million ($3.9 million) was reduced after the bank agreed to settle.

The penalty also includes the disgorgement of Mirabaud’s economic benefit from the illegal activity amounting to AED 3.5 million ($975,000).

Investigations revealed that the Mirabaud processed transactions, for a group of nine interconnected client accounts managed by the same Relationship Manager, without recognising clear indicators of potential money laundering or take the appropriate action when it had concerns about customers’ activity.

It showed how the transactions were made "outside the accounts’ expected activity, for purposes prohibited under Mirabaud’s own policies, inconsistent with the profile of the clients and supported by information inconsistent with that which was already held about the customers".

This showed how the bank's AML policies and procedures were ineffective.

The relationship manager responsible for these customers has since left Mirabaud, as have the individuals that held the roles of senior executive officer and chief compliance officer during the time these failings occurred.

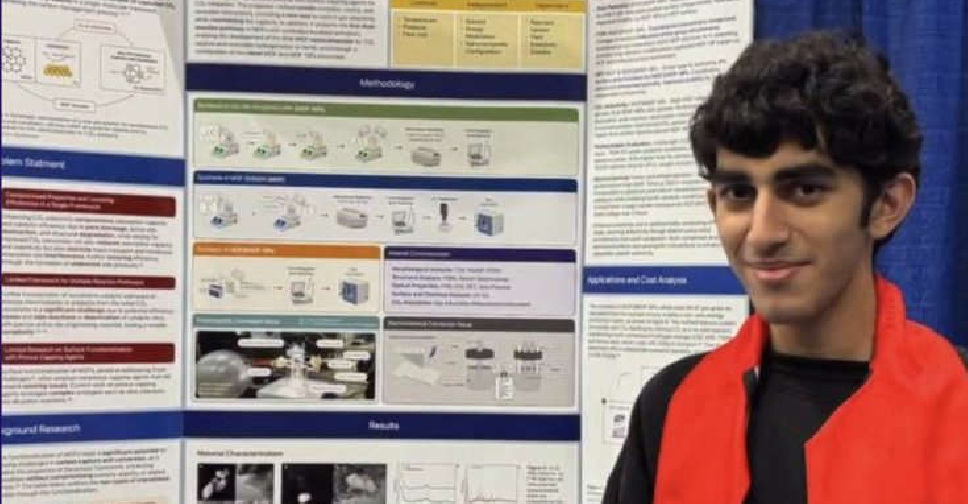

Sharjah student wins third place at ISEF

Sharjah student wins third place at ISEF

RTA announces truck movement timings

RTA announces truck movement timings

Dubai school buses allowed to display advertisements

Dubai school buses allowed to display advertisements

Two Abu Dhabi policemen die in road accident while on duty

Two Abu Dhabi policemen die in road accident while on duty