Now Marissa Mayer is really testing investors’ patience. After watching her spend three years struggling to turn around Yahoo! Inc., Wall Street woke up on Wednesday to learn that Mayer was abandoning a long-anticipated plan to sell a $30 billion stake in Alibaba Group Holding Ltd. Though the decision was made to avoid a potentially large tax hit, Mayer said the new strategy would take more than a year to get done - meaning more distraction for a management team struggling to catch up with Google and Facebook. “It’s a tough company to turn around,” said Colin Gillis, an analyst with BGC Partners. “But flip-flopping on plans last-minute certainly is not going to endear this management team to certain shareholders.” The board has expressed support for the CEO, and Mayer says she’s committed to Yahoo. Even so, there’s no guarantee she’ll survive the year. Starboard Value, the hedge fund that pushed Mayer to reverse the Alibaba plan, didn’t get everything it wanted and will almost certainly step up pressure for a sale of the main search and display advertising businesses. Yahoo’s battered stock, already down almost a third this year, fell as much as 4.9% on Wednesday. Starboard, which in recent weeks has threatened to mount a proxy fight for board control, declined to comment. Multiple Strategies No one says Mayer had an easy task when she was poached from Google to turn around Yahoo in 2012. The pioneering Web company had veered from one strategy to another. One year it was a media company; the next a Google wannabe. Mayer set to work improving Yahoo’s e-mail and media products as well as the mobile experience. She landed high-profile hires, closed big-name acquisitions and focused the company on more cutting-edge technologies. Analysts credit Mayer for improving Yahoo’s mobile, video and social offerings but say these new growth drivers aren’t offsetting declines in the legacy desktop business. In an interview, Mayer acknowledged her job was far from done, but said the company has made progress. “We built ourselves a future,” she said. “My deep belief in the company and where it should be in the world is what keeps me going. And I’m absolutely very committed.” ‘Crazy Week’ Yahoo Chairman Maynard Webb, a former EBay Inc. executive, said the board remains committed to the management team. "I have never worked with anybody - and I’ve worked with alot of superstars - that’s more committed, that works harder,”he said in an interview. “We went through a crazy week of preparation for our board meeting - over Thanksgiving - and she worked night and day.” But Mayer may be trying to do the impossible. Yahoo’s share of U.S. digital advertising spending is forecast to fall to 3.5% in 2017, from 11.5% in 2009, according to EMarketer Inc. Revenue peaked at $5.4 billion in 2008, and is projected to slip 8% this year to $4.04 billion, minus revenue passed on to partner sites. As a result, Yahoo may not be viable as a standalone company. Already, Verizon has expressed interest in possibly acquiring Yahoo. And it won’t be the only one. “I think we’re reaching the end-game in Yahoo,” said Aswath Damodaran, a finance professor at New York University. “Mayer needs to start thinking about her future. What happens with Mayer is in her hands.” (By Brian Womack and Selina Wang/Bloomberg)

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

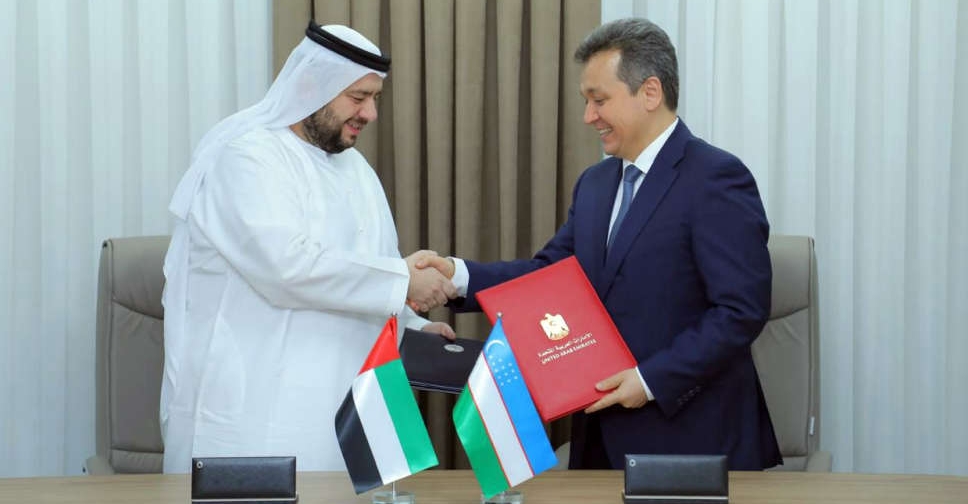

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors