Uber Technologies Inc. said it received its biggest investment to date, raising $3.5 billion from the Public Investment Fund of Saudi Arabia. The investment valued Uber at $62.5 billion, the same amount as its previous valuation, the company said. Yasir Al Rumayyan, the managing director of Saudi Arabia’s sovereign wealth fund, will take a board seat. Saudi Arabia has been looking for ways to diversify its investments outside of the oil industry. Lyft Inc., the second-largest ride-hailing company in the U.S., has raised at least $100 million from Saudi Arabian billionaire Prince Alwaleed Bin Talal’s Kingdom Holding Co. “As the Kingdom of Saudi Arabia’s sovereign investment arm, we’re focused on achieving attractive long-term financial returns from our investments,” Al Rumayyan said in a statement. Uber expanded its previous financing round to include the investment from Saudi Arabia’s Public Investment Fund. The money brings Uber’s total balance sheet, including cash and convertible debt, to more than $11 billion, the company said. The cash infusion helps the company push off the need to go public. Uber is currently operating in nine countries and 15 cities in the Middle East and North Africa. The company said it has committed to investing $250 million in the region. It’s continuing to spend much more than that in China and India. There’s no shortage of investment to ride-hailing companies around the world. Didi Chuxing, a Chinese ride-hailing company that’s Uber’s biggest global competitor, said last month that it raised $1 billion from Apple Inc. Alibaba Group Holding Ltd. and its finance affiliate invested another $400 million in the Chinese company. India’s Ola is also well-capitalized and spending aggressively on expansion. By Eric Newcomer/Bloomberg

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

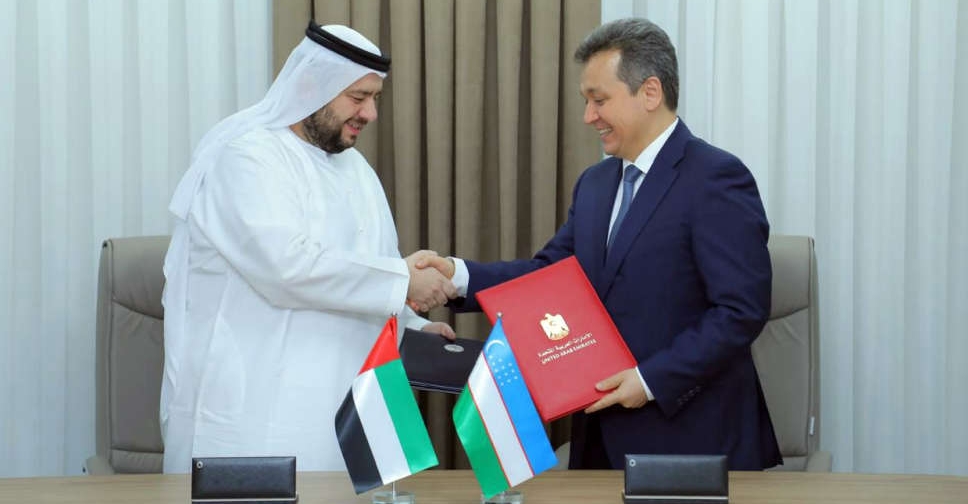

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors