Public benefit entities in the UAE will be exempt from corporate tax under a new Cabinet decision, the Ministry of Finance announced.

This exemption recognises the important role played in areas such as religion, charity, science, education and culture.

To remain eligible, these entities must comply with relevant laws and notify the Ministry of Finance of any changes that may affect their status.

Those exempt can receive donations and will be recognised as deductible expenses under Article 33 of the Corporate Tax Law.

The Cabinet can modify the list of qualifying entities based on the Finance Minister's recommendation.

UAE-Vietnam CEPA enters into force

UAE-Vietnam CEPA enters into force

Indian rupee, stocks soar in relief rally after trade deal with US

Indian rupee, stocks soar in relief rally after trade deal with US

UAE, DR Congo sign CEPA to strengthen economic partnership

UAE, DR Congo sign CEPA to strengthen economic partnership

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

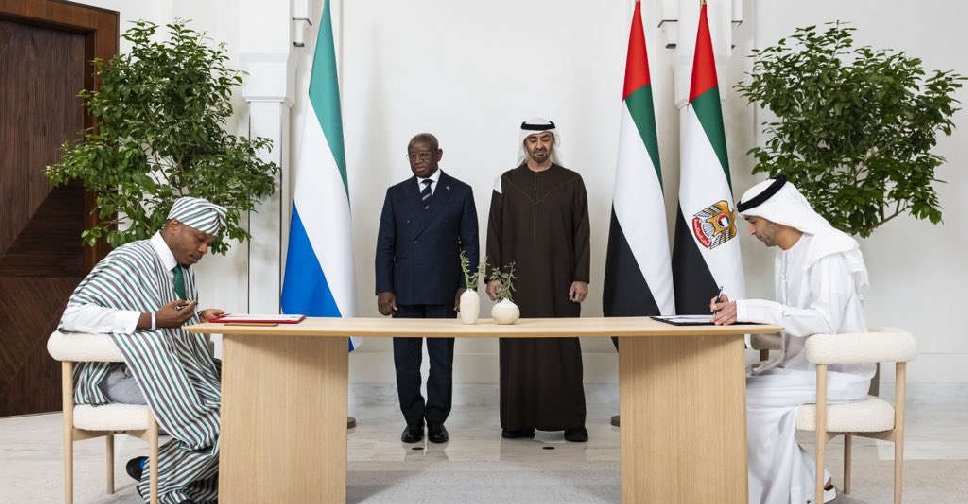

UAE and Sierra Leone sign major trade pact

UAE and Sierra Leone sign major trade pact