UAE banks will see negative earnings growth this year as low oil prices take their toll and liquidity continues to tighten, according to a report by Standard & Poor’s. Experts suggest that the slowdown will continue through to 2017. They note that unlike the global financial crisis in 2010, strong oil prices won’t get liquidity flowing again. Meanwhile, five UAE banks are rated stable by S&P because of their healthy liquidity, good loan loss coverage and strong capitalisation levels. They include National Bank of Abu Dhabi, Abu Dhabi Commercial Bank, Mashreq Bank, Sharjah Islamic Bank and National Bank of Fujairah. The report also adds that the UAE's banking sector is still one of the most profitable among emerging markets.

Indian rupee, stocks soar in relief rally after trade deal with US

Indian rupee, stocks soar in relief rally after trade deal with US

UAE, DR Congo sign CEPA to strengthen economic partnership

UAE, DR Congo sign CEPA to strengthen economic partnership

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

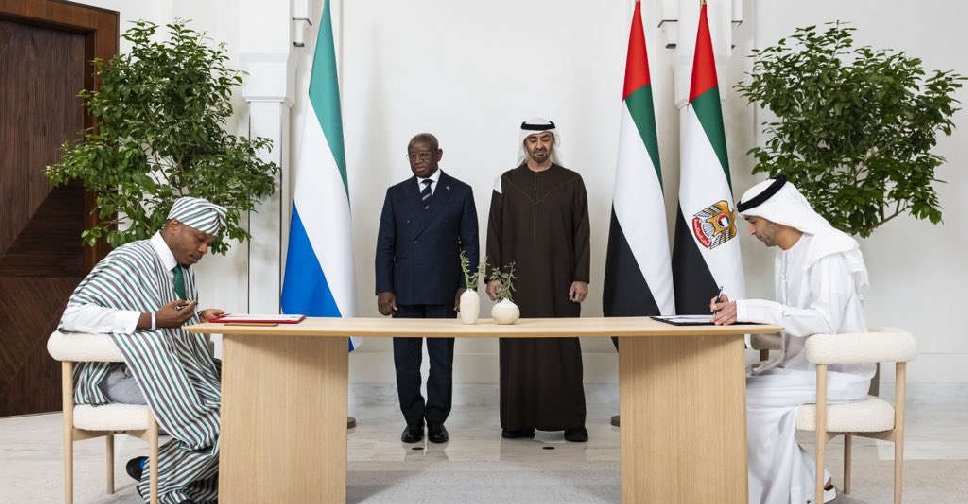

UAE and Sierra Leone sign major trade pact

UAE and Sierra Leone sign major trade pact

IMF chief praises UAE's model of economic diversification

IMF chief praises UAE's model of economic diversification