Abu Dhabi National Energy Company (TAQA) has signed an agreement to gain full ownership of Madrid-based water company GS Inima for $1.2 billion, strengthening its position as a global low-carbon water champion.

With a presence in 10 countries, including Brazil, Mexico, the US and Oman, GS Inima provides TAQA with immediate access to high-growth markets across Europe, Latin America and Asia.

The transaction is subject to regulatory approvals and other closing conditions, customary for a transaction of this nature and is expected to close in 2026.The acquisition will immediately add an additional 1.2 million cubic metres per day of drinking water capacity and 2.6 million cubic metres per day of wastewater and industrial water treatment capacity.

GS Inima operates 50 active projects, including 30 long-term public-private partnerships (PPPs), across a portfolio spanning water desalination and water treatment. The acquisition will immediately add approximately 171 million imperial gallons per day (MIGD) of desalination capacity to TAQA’s 1,250 MIGD portfolio, and helps advance its goal to source two-thirds of its water desalination capacity from energy-efficient reverse osmosis (RO) technology by 2030 through the addition of RO plants.

GS Inima's integrated offering across the water value chain will contribute an additional 1.2 million cubic metres per day (264 MIGD) of drinking water capacity and 2.6 million cubic metres per day (572 MIGD) of wastewater and industrial water treatment capacity to TAQA's global water platform, as well as a water management business serving 1.3 million inhabitants.

GS Inima is expected to contribute to TAQA’s financial performance, with strong additions to EBITDA upon closing. In 2024, the company generated annual revenue of approximately €389 million and EBITDA of €106 million, reinforcing the quality and scale of earnings that TAQA expects to add to its portfolio.

The majority of the company’s portfolio (excluding EPCm portion) operates under long-term concession agreements that include inflation-adjustment mechanisms, offering stable and predictable cash flows. In addition, GS Inima’s advanced digital technologies and focus on R&D will unlock long-term value by enhancing TAQA’s operational efficiencies and technical capabilities across its water platform.

The integration strengthens TAQA’s ability to scale smart water infrastructure and complements the Group’s broader strategy of expanding operational capabilities through a combination of project wins and targeted acquisitions.

The acquisition builds on momentum from the past 12 months, during which TAQA took significant steps to broaden its water capabilities both at home and abroad. Domestically, the Group expanded its presence in wastewater and recycled water through the acquisition of Sustainable Water Solutions Holding, now operating as TAQA Water Solutions.

Internationally, TAQA has committed to large-scale infrastructure projects that advance long-term water security, including several developments projects in Morocco and Uzbekistan. These initiatives have reinforced TAQA’s commitment to enabling long-term water security in high-priority markets, while also expanding its global footprint.

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

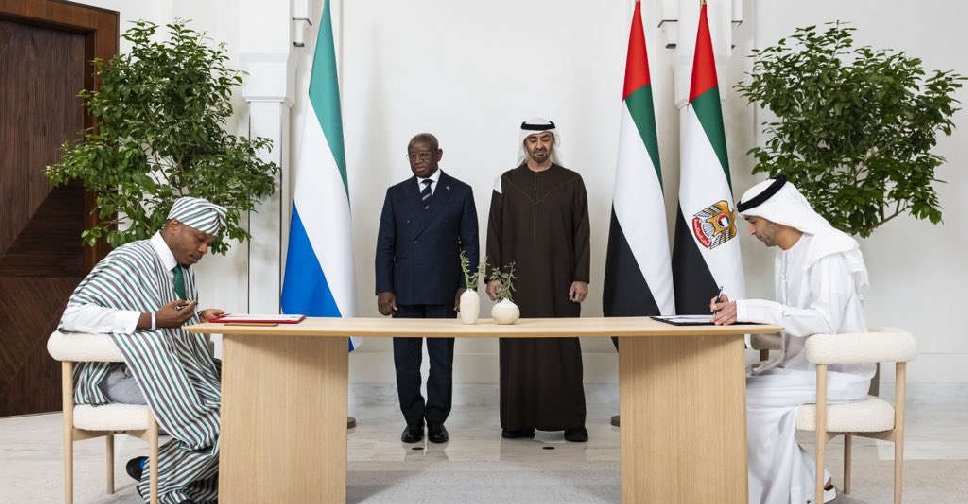

UAE and Sierra Leone sign major trade pact

UAE and Sierra Leone sign major trade pact

IMF chief praises UAE's model of economic diversification

IMF chief praises UAE's model of economic diversification

India budget seeks manufacturing pivot, but falls short of expectations

India budget seeks manufacturing pivot, but falls short of expectations

Dubai Duty Free records highest ever January sales

Dubai Duty Free records highest ever January sales