Elon Musk has secured $7.14 billion (AED 26.22 billion) in funding from a group of investors that includes Oracle Corp co-founder Larry Ellison and Sequoia Capital to fund his $44 billion takeover of Twitter.

According to a filing on Thursday, Saudi Arabian investor Prince Alwaleed bin Talal, who had initially opposed the buyout, also agreed to roll his $1.89 billion stake into the deal rather than cashing out.

The move comes as Musk's margin loan was reduced to $6.25 billion from $12.5 billion announced earlier.

Musk's $21 billion financing commitment was also revised to $27.25 billion.

Musk will continue to hold talks with existing shareholders of Twitter, including the company's former chief Jack Dorsey, to contribute shares to the proposed acquisition, the filing showed.

Qatar Holding and Dubai-based Vy Capital, also an investor in Musk's other venture The Boring Company, are also part of the investor group.

Reuters last week reported Musk was in talks with large investment firms and high net-worth individuals about taking on more financing for his Twitter acquisition and tying up less of his wealth in the deal.

Larry Ellison, a board member at Tesla and a self-described close friend of Elon Musk has committed $1 billion for the funding.

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

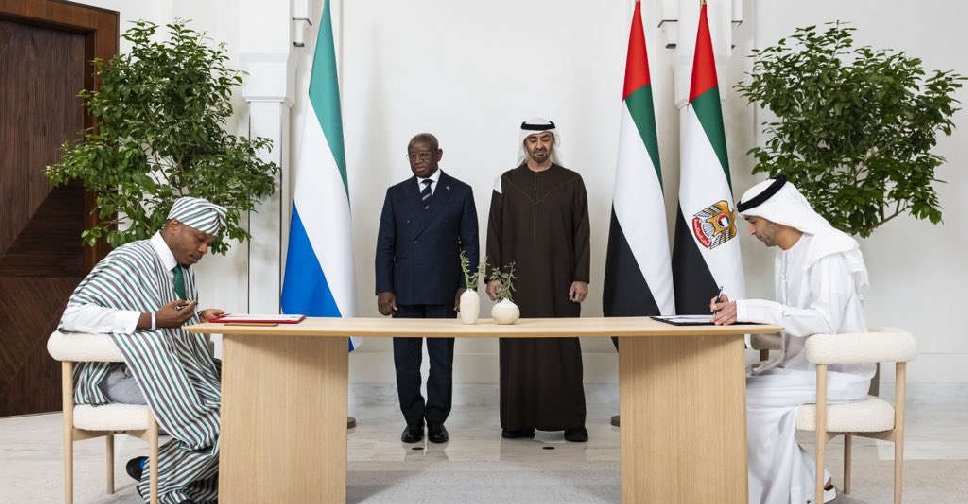

UAE and Sierra Leone sign major trade pact

UAE and Sierra Leone sign major trade pact

IMF chief praises UAE's model of economic diversification

IMF chief praises UAE's model of economic diversification

India budget seeks manufacturing pivot, but falls short of expectations

India budget seeks manufacturing pivot, but falls short of expectations

Dubai Duty Free records highest ever January sales

Dubai Duty Free records highest ever January sales