India’s war on cash has at least two likely victors - Visa Inc. and Mastercard Inc. The world’s largest payment networks will see a surge in transactions and cardholders after the Indian government’s decision in November to remove high-denomination bills from circulation, according to analysts who cover the companies. The two networks have been pushing for this kind of change in India, where a McKinsey & Co. study found that more than 90 per cent of transactions are still conducted in cash. “Visa and Mastercard both benefit as paper currency or checks turn toward electronics,” said Moshe Orenbuch, an analyst at Credit Suisse Group AG who has a buy recommendation on both stocks. “When we think about where they are investing, they look toward areas where there is the potential to accelerate that transition,” he said, adding that the recent changes in India are “something they know how to move in on.” Five-hundred rupee (AED 27) and 1,000-rupee (AED 54) notes ceased to be legal tender in India on November 9 and must be deposited in banks by the end of the year, Indian Prime Minister Narendra Modi said in a surprise announcement, sweeping away 86 per cent of the total currency in circulation. The move is seen as an attempt to fulfil his election promise of curbing tax evasion and recovering illegal income, locally known as black money, stashed overseas. (Jenny Surane/Bloomberg)

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

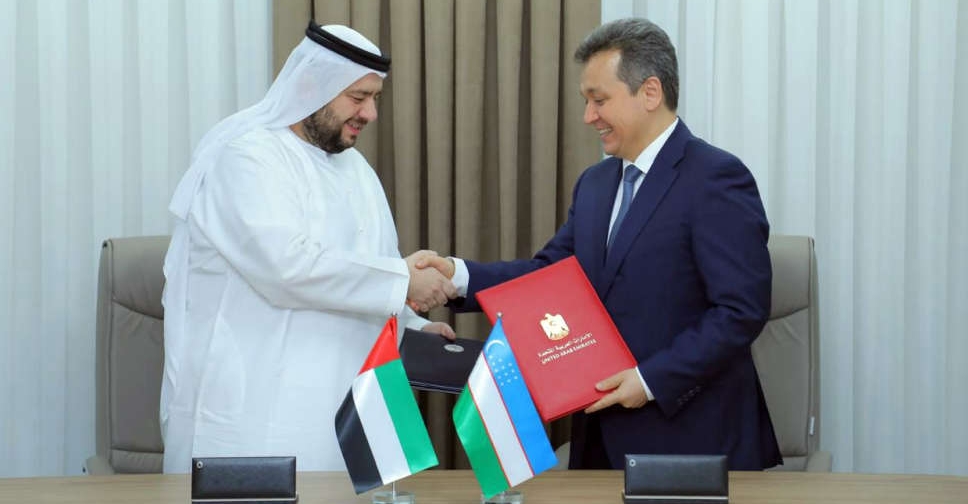

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors