Kuwait's Council of Ministers has approved a new tax measure that will impose a 15% tax on multinational entities, effective January 1 of next year.

The tax will apply to companies operating across multiple countries or jurisdictions.

Sherida Abdullah Al-Muasherji, Kuwait’s Deputy Prime Minister and Minister of State for Cabinet Affairs, confirmed the approval of the "Multinational Entities Group Tax Law."

The move aligns with international tax standards and is designed to curb tax evasion and prevent the leakage of tax revenues to other countries.

This new law reflects Kuwait's ongoing efforts to strengthen its tax framework and ensure better compliance with global tax regulations.

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

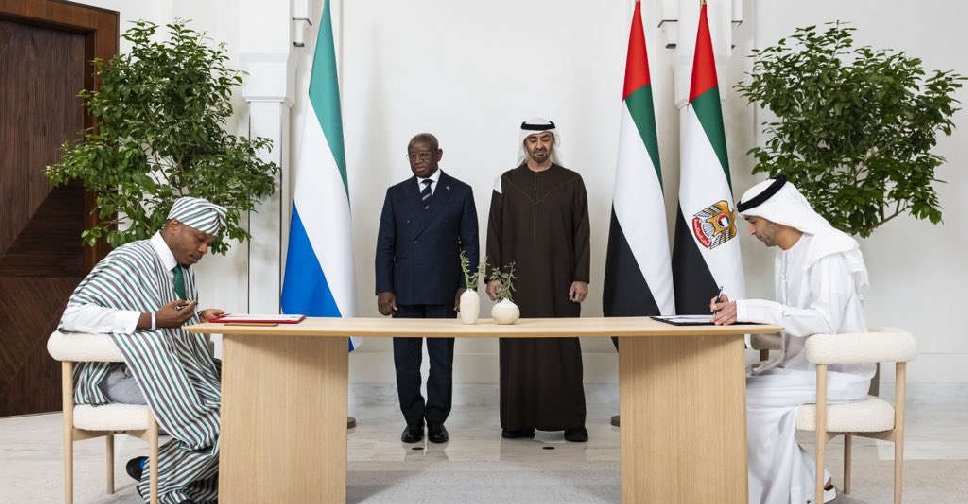

UAE and Sierra Leone sign major trade pact

UAE and Sierra Leone sign major trade pact

IMF chief praises UAE's model of economic diversification

IMF chief praises UAE's model of economic diversification

India budget seeks manufacturing pivot, but falls short of expectations

India budget seeks manufacturing pivot, but falls short of expectations

Dubai Duty Free records highest ever January sales

Dubai Duty Free records highest ever January sales