US media behemoth Walt Disney and Indian conglomerate Reliance Industries were the major winners in a high-stakes bid to broadcast the IPL for the next five years in deals fetching the organisers $6.2 billion.

Disney-owned Star India retained the television broadcast rights to the IPL for 235.75 billion Indian rupees ($3.02 billion), Jay Shah, a top cricket board official said on Tuesday, after a three-day online auction saw the league's broadcast value triple from the last one in 2017.

At $3.02 billion, Disney will pay over a billion dollars more than its previous bid in 2017, which also included online streaming rights.

Viacom18, a broadcasting joint venture run by Mukesh Ambani's Reliance Industries, won digital streaming rights from 2023 to 2027, for 237.58 billion Indian rupees.

The BCCI received a total of 483.9 billion Indian rupees from the media rights for the five-year period, BCCI secretary Shah said in a series of tweets.

"IPL is now the 2nd most valued sporting league in the world in terms of per match value," he tweeted.

Disney's Hotstar Plus platform, which has so far streamed the IPL, is the market leader in India's crowded online streaming market, with more than 50 million paid subscribers, which analysts attribute mostly to its strong cricket content.

There were four sets of bids that took place in the online auction, two of which went to Viacom18 and Disney.

The BCCI did not specify which companies won the other two bids, which included a bespoke package that includes high-value matches as well as rights to broadcast in foreign territories.

Launched in 2008, the IPL, counting top Indian industrialists and Bollywood stars such as Shah Rukh Khan among its franchise owners, is often seen as a surefire ticket to high TV ratings and growth in India's booming online streaming space.

The glitzy T20 league attracts the world's best cricketers for two months of fast-paced matches played in front of packed stadiums.

LONG-TERM VALUE

"We made disciplined bids with a focus on long-term value. We chose not to proceed with the digital rights given the price required to secure that package," Rebecca Campbell, Chairman, International Content and Operations at Walt Disney, said in a statement on Tuesday.

But analysts say the lack of cricket in its arsenal could hurt Disney's position as the market leader and arm Reliance with a potent weapon to capture the Indian streaming market in the next five years.

"The fact that digital rights value is higher than television showcases the scale and future potential of streaming in India," Mihir Shah, Vice President at consultants Media Partners Asia, said.

For Mukesh Ambani's Reliance, which will stream the IPL for the first time, the deal plays into the company's larger plans for its telecom and tech arm Jio, which has 400 million broadband customers, Shah said.

India's booming digital market, fuelled by cheap data, low-budget phones and a burgeoning middle-class who are hungry for content is a tempting prospect for conglomerates like Reliance.

"Digital media revenues are estimated to grow at a faster pace of 30 per cent, whereas TV revenue is estimated to grow in a narrow band of 6-8% over the next five years," Karan Taurani, an analyst with research firm Elara capital, said.

Others in the race included Sony Corp's India unit and local broadcaster Zee Entertainment, both of whom are in the middle of a proposed merger.

"We had to factor in the market's anticipated expansion and potential economic and other concerns over the next five years. Fiscal prudence, in my opinion, is critical for strategic management," N P Singh, Managing Director and CEO Sony Pictures Networks India, said in a statement.

Bidding for the media rights began on Sunday.

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

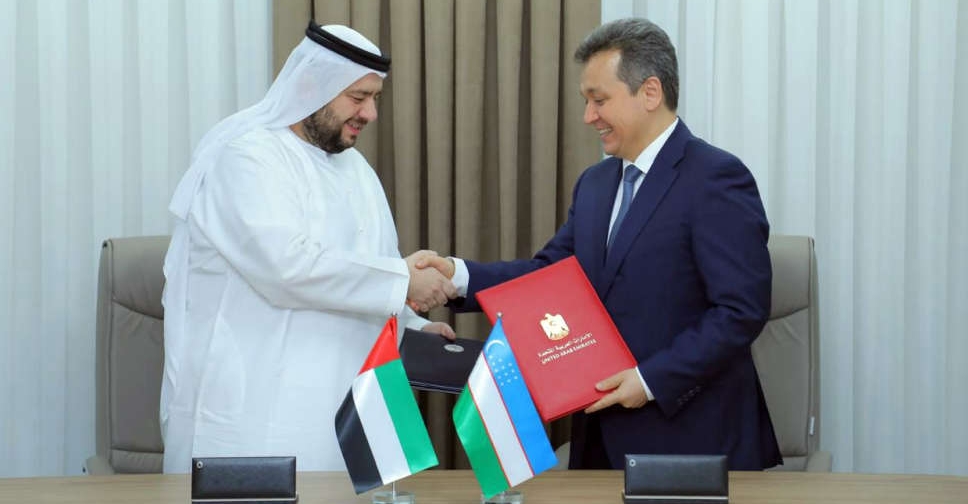

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors