Halliburton Co. and Baker Hughes Inc. will extend the time period to April 30 for closing their pending $26 billion (Dh 95.5 billion) merger as they work to satisfy Justice Department concerns. The U.S. Justice Department told the world’s No. 2 and No. 3 oil service companies that officials aren’t satisfied with Halliburton’s proposals for clearing its purchase of Baker Hughes, but acknowledged that regulators would assess further proposals and look forward to continued cooperation from the parties in their ongoing investigation, the companies said in a statement on Tuesday. "Both companies strongly believe that the divestiture package, which recently was significantly enhanced to address the DOJ’s specific competitive concerns, is more than sufficient to address concerns raised by competition authorities, including the DOJ," according to the statement. Halliburton announced an agreement to buy Baker Hughes in November 2014 to better compete against industry leader Schlumberger Ltd. by achieving scale and building a better technology portfolio in a market where the ability to innovate is increasingly critical for success. At that time, Halliburton said it planned to divest assets that generate as much as $7.5 billion (Dh 27.54 billion) in annual revenue to win antitrust approval. Baker Hughes fell 0.6% to $46.50 in New York, while Halliburton rose 1.5% to $37.10. The assets put up for sale so far amount to $5.2 billion (Dh 19.1 billion) in 2013 revenue, the benchmark year the companies are using for the threshold. After oil prices plunged by more than half since June 2014, those assets are expected to see their sales fall to $3.9 billion (Dh 14.32 billion) this year, according to Spears & Associates, a Tulsa, Oklahoma, oilfield research consultant. "The companies intend to continue their discussions with the DOJ, and remain focused on completing the transaction as early as possible in 2016, but there is no guarantee that an agreement with the DOJ or other competition authorities will be reached," the companies said. If the Justice Department is not “comfortable with divestitures to date, that doesn’t mean it can’t ultimately get comfortable,” James West, an analyst at Evercore ISI in New York, who rates the shares of both companies a buy and owns none, wrote in an e-mail before the release. He added in a note to investors Tuesday that Halliburton would be willing to sell more assets, with the total threshold adding up to as much as $10 billion (Dh 36.7 billion) in annual revenue. The companies previously agreed to an extension until Tuesday with the Justice Department over the merger. The U.S. antitrust officials aren’t obligated to complete their review by today, Bloomberg News reported earlier, citing a person familiar with the situation. The companies can’t close their deal because antitrust officials in Europe, Australia and Brazil are also reviewing how the deal could change the competitive landscape. Ultimately Tuesday’s announcement doesn’t resolve much, J. David Anderson, an analyst at Barclays Plc in New York, said in a phone interview. "It’s more or less a punt," Anderson said. "It’s sort of locking in more uncertainty well into next year." (David Wethe and David McLaughlin/ Bloomberg)

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

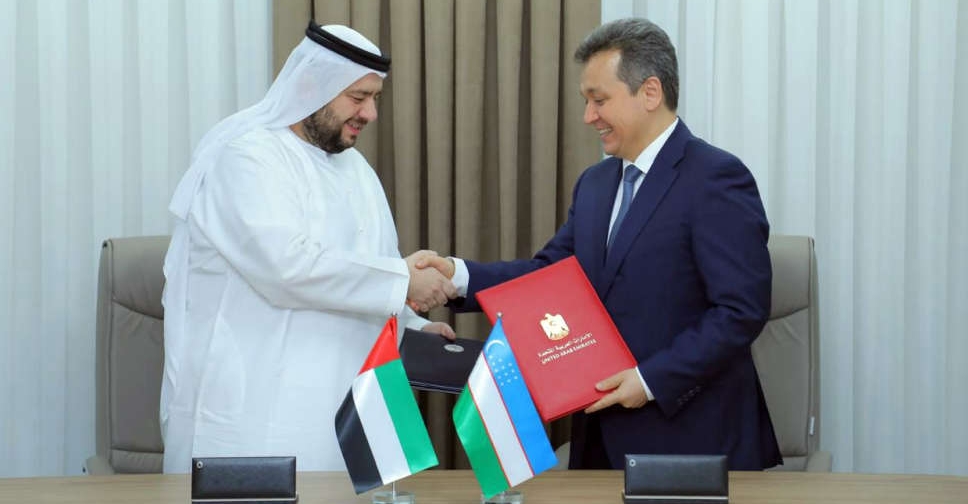

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors