Ferrari NV’s initial public offering (IPO) is oversubscribed throughout its price range as investor interest in the supercar-maker outstrips the shares available, people familiar with the matter said. Investors had indicated to bankers last week before the sale began that demand would far exceed the available number of shares, and those predictions have been borne out, said the people, who asked not to be named because the process is private. The books close on Monday at 4 p.m. in all regions, two of the people said. The interest in Ferrari comes as investors have shied away from other IPOs. Three U.S. offerings faltered within about a week this month, as Digicel Group Ltd. canceled a sale, First Data Corp. priced shares below a marketed range and Albertsons Cos. postponed its offering. The share sale, which has been in the works for about a year, is critical to help Fiat Chrysler finance a 48 billion-euro ($54.6 billion) investment program focused on expanding the Jeep, Alfa Romeo and Maserati nameplates globally. Chairman Sergio Marchionne, also chief executive officer of parent Fiat Chrysler Automobiles NV, has taken both companies’ stories on the road in London, New York and Ferrari’s home in Maranello, Italy. Final pricing is expected late Tuesday, with trading due to start on Wednesday, the people said. Ferrari plans to sell as many as 18.89 million shares, 10% of the company, at $48 to $52 each, according to an October 9 filing with the U.S. Securities and Exchange Commission. The shares will trade on the New York Stock Exchange under the symbol RACE. The company declined to comment on the IPO process. The public listing will raise more than $4 billion for Fiat Chrysler, thanks to additional cash the Italian-American manufacturer will squeeze out of Ferrari before spinning it off completely early next year. Including debt Ferrari will take on from Fiat, the company will have an enterprise value of about $12 billion. Fiat Chrysler is keeping the share volume in the IPO limited to ensure robust demand, just as Ferrari boosts its own product allure by capping the number of cars it makes. After the share sale, Fiat Chrysler then plans to distribute its remaining 80% Ferrari holding to its own investors early next year. Piero Ferrari, the son of the brand’s founder, will retain his 10% holding.

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

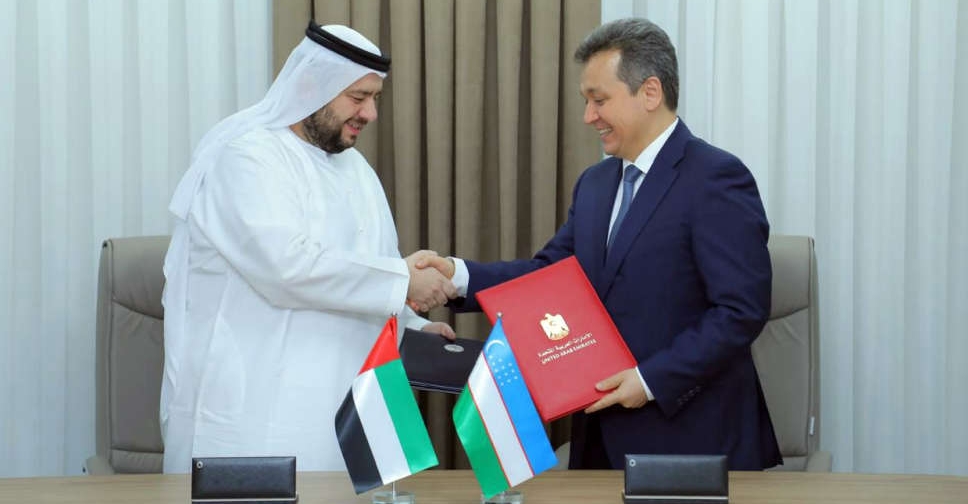

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors