Dubai stocks gained a fifth day amid declining trading across Gulf Arab equity markets, with some investors taking a long weekend and the start of Ramadan about a week away. The DFM General Index rose 0.3 percent, capping the longest winning streak since September. About 140 million shares were traded on the emirate’s main measure, less than half of the six-month average. Bloomberg’s GCC 200 Index, which tracks the biggest and most liquid stocks in the six-nation Gulf Cooperation Council, fell 0.5 percent, on course for its first monthly decline since January. “The typical languid Sunday trading has been exacerbated by a holiday tomorrow in the U.K. and U.S., causing western activity to be reduced further,” said Julian Bruce, the head of institutional trading at EFG-Hermes U.A.E. Ltd. in Dubai, a unit of the biggest publicly traded Arab investment bank. That may be “creating a calm-before-the-storm scenario, as MSCI emerging market outflows are anticipated on Tuesday, which would mean a significant uptick in activity before receding once again ahead of Ramadan,” he said. MSCI Inc., the global index provider tracked by 97 of the 100 biggest asset managers in the world, will at the end of the month adjust Chinese companies on its emerging-markets gauge. That may help spur as much as $157 million of outflows from stocks in the Middle East and North Africa, according to EFG Hermes. Meanwhile, the holy month of Ramadan, when most Muslims fast all day and business and trading across the GCC typically slows, will this year start around June 6. U.A.E. Gains Dubai Islamic Bank PJSC led gains in the emirate, rising 2.9 percent. It was one of six stocks to gain, outweighing 17 decliners. In Abu Dhabi, the ADX General Index added 0.3 percent. Sharjah Islamic Bank, which said it repaid a $400 million sukuk from its own funds and will look to tap the market “at appropriate times,” was unchanged. Eshraq Properties Co. slipped 1.3 percent as almost 67 million shares were exchanged. Qatar’s QE Index retreated 0.4 percent as 1.4 million shares traded on the main measure, compared with a 20-day average of 4.3 million. Qatar National Bank SAQ declined 0.4 percent. The lender said on Saturday it raised a 2.25 billion euro ($2.5 billion) loan with 14 banks, upsizing from 1.5 billion euros based on demand. Bahrain’s BB All Share Index lost 0.2 percent. Dual-listed GFH Financial Group BSC dropped 1.2 percent in Dubai, and didn’t trade in Manama. The company plans to list Khaleeji Commercial Bank in Dubai, Al Arabiya reported. Saudi Devaluation Saudi Arabia’s Tadawul All Share Index fell 0.8 percent. The country’s central bank, the Saudi Arabian Monetary Authority, is probing the trade in options used to bet whether the kingdom will weaken its currency, people familiar with the matter said last week. One-year forward contracts for the riyal closed last week at the highest level since February, according to data compiled by Bloomberg. About 167 million shared traded in the kingdom, 41 percent below the average of the past six months. With “summer and with Ramadan approaching, not too many traders are eager to trade ahead of the start of the holy month,” said Mohammed Alsuwayed, the Riyadh-based head of capital and money markets at Adeem Capital. “It doesn’t mean that the market is not attractive.” Kuwait’s Americana Kuwait’s SE Price Index dropped 0.1 percent in trading volumes almost 10 percent higher than the six-month average. Agility Public Warehousing Co. was the largest contributor to the decline as it traded without the right to its dividend. Kuwait Food Co., the Middle Eastern operator of franchises including Pizza Hut and KFC, was suspended after a deal to acquire 69 percent of the company collapsed. Talks for the $1.8 billion buyout with the United Arab Emirates’ Adeptio LLC ended without agreement, the company known as Americana and its main shareholder said in a statement to the bourse. Egypt Slips Egypt’s EGX 30 Index retreated 0.6 percent on 71 percent less than the six-month average trading volume. Telecom Egypt rose 0.7 percent after Shorouk newspaper reported the company is in talks for a 5 billion Egyptian pound ($563 million) loan to finance the acquisition of a 4G license from the government. The North African country hired a deep ocean survey and recovery company to join the search for wreckage of the EgyptAir plane that crashed into the Mediterranean Sea on May 19, killing all 66 people on board. The main stocks gauge fell 2 percent since the incident, compared with a 1.8 percent advance for MSCI Inc.’s emerging markets index. Commercial International Bank Egypt, the company that makes up almost 40 percent of the benchmark gauge, fell 0.3 percent to lead declines. The lender said the deadline for selling its investment banking unit to Beltone Financial has been extended to June 9. Shares of Beltone dropped 1.3 percent.

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

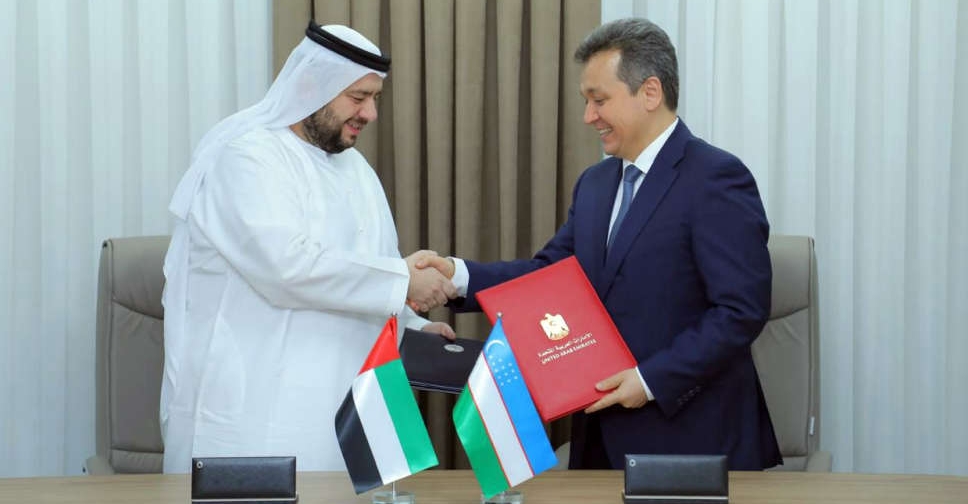

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors