Dubai Holding is seeking to raise up to AED 1.79 billion ($487 million) through the Initial Public Offer (IPO) of its residential real estate investment trust (REIT).

One of the largest real estate developers in the UAE, the company is offering a stake of 12.5 per cent in Dubai Residential REIT at a price ranging from AED 1.07 to AED 1.10 per unit.

That range values the REIT at up to $3.9 billion.

It is expected to distribute at least AED 1.1 billion in dividends for 2025.

The institutional book-building subscription period for the IPO will close on May 20, the company said, with trading set to begin on or around May 28.

Citi, Emirates NBD and Morgan Stanley are joint global coordinators and joint bookrunners for the IPO.

The fund’s portfolio covers 21 residential communities strategically located across Dubai, comprising more than 35,700 residential units—95 percent apartments and five percent villas. The portfolio achieved an average occupancy rate of over 96.8 percent last year, with a tenant retention rate of 87 percent.

Indian rupee, stocks soar in relief rally after trade deal with US

Indian rupee, stocks soar in relief rally after trade deal with US

UAE, DR Congo sign CEPA to strengthen economic partnership

UAE, DR Congo sign CEPA to strengthen economic partnership

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

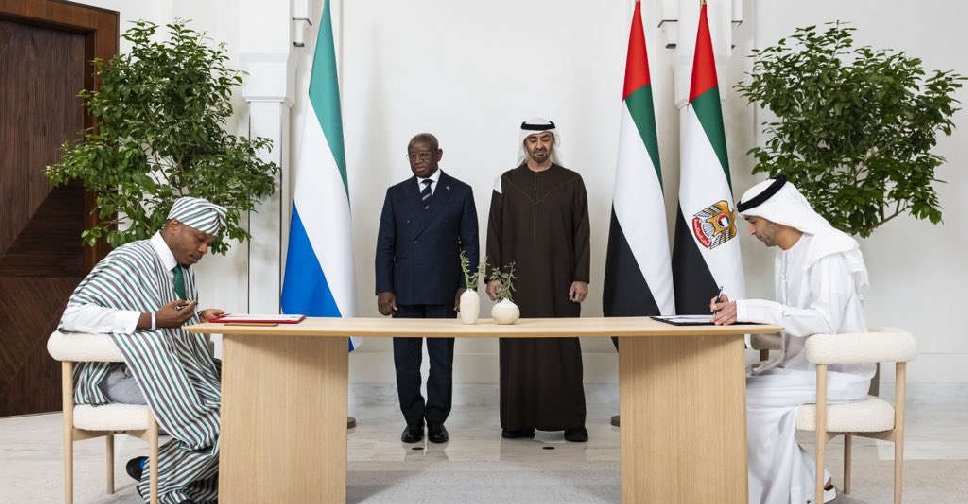

UAE and Sierra Leone sign major trade pact

UAE and Sierra Leone sign major trade pact

IMF chief praises UAE's model of economic diversification

IMF chief praises UAE's model of economic diversification