The Governor of the Bank of England Mark Carney has announced measures to allow banks to increase lending for households and businesses, following the UK's decision to end its EU membership. The Bank admits that the UK case entered a period of uncertainty and significant economic adjustment, but that it will weather the effects of Brexit by giving more flexibility to three quarters of UK banks. Further measures are expected to be announced in the comping months on the Bank's Monetary Stimulus policy. Mr Carney warned that the Bank would not be able to fully offset Brexit volatility, but that capital buffers will be put in place to try to sure up the UK's economy.

Listen

UAE, DR Congo sign CEPA to strengthen economic partnership

UAE, DR Congo sign CEPA to strengthen economic partnership

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

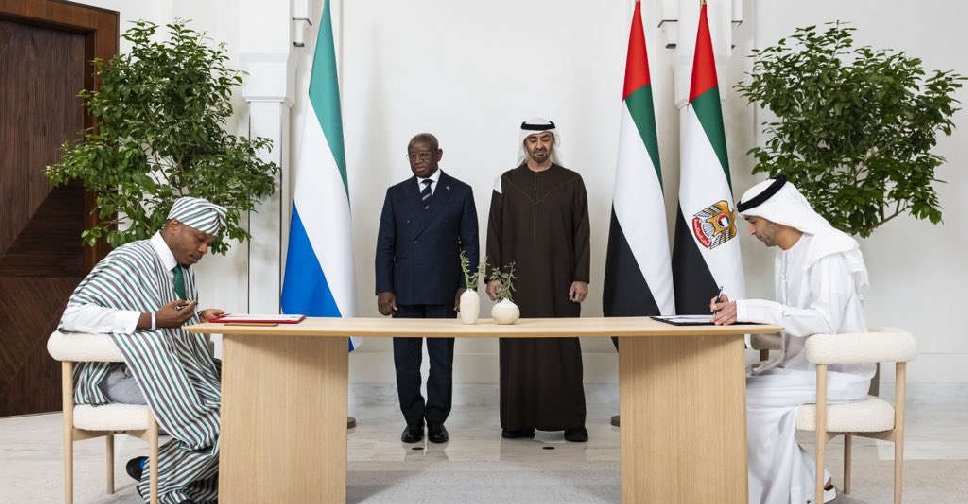

UAE and Sierra Leone sign major trade pact

UAE and Sierra Leone sign major trade pact

IMF chief praises UAE's model of economic diversification

IMF chief praises UAE's model of economic diversification

India budget seeks manufacturing pivot, but falls short of expectations

India budget seeks manufacturing pivot, but falls short of expectations