India is opening the door to foreigners to prod its powerful state governments into doing more to boost economic growth. Starting Monday, overseas investors can buy as much as 500 billion rupees (AED28.2 billion) of state debt through 2018 after the central bank opened the sector to develop India’s financial markets. Barclays Plc and Bank of America Merrill Lynch see strong demand for the bonds, which are as safe as sovereign notes and offer yields about 50 basis points higher. Prime Minister Narendra Modi is pushing state leaders to play a greater role in jumpstarting an economy that is expanding below potential even as it boasts one of the world’s fastest growth rates. State governments have control over land, water and electricity, making them essential to attracting investment. Modi is sharing a record 42 percent of tax revenues with state governments and is trying to push through legislation that will unify them under a single national sales tax. Working together, India’s 29 states would form a bloc that has a bigger economy than the whole of sub-Saharan Africa, more members than the European Union, and twice the population of North America. State budget deficits have halved to about 2.5 percent of gross domestic product over the past 15 years. Between April to September, their governments have spent more than Modi’s administration and are poised to outstrip federal spending for the first time in at least six years. "Indian States are benefiting from growth deepening after 25 years of reforms," BoFAML economists Indranil Sen Gupta and Abhishek Gupta wrote in an October 5 report, referring to an economic overhaul since India first opened its economy in 1991. "Rising aspirations are putting pressure on state governments to follow pro-development policies." The investment cap will be 35 billion rupees (AED198.3 million) this year, and will steadily rise to 500 billion rupees (AED28.2 billion) by 2018. The limits will be “fully utilized” given the appetite for government securities among offshore investors, the BoFAML economists wrote. India’s $207 billion (AED760 billion) of outstanding state bonds currently account for 19 percent of the overall debt market and are "far less liquid" than federal debt, according to Barclays. That justifies their roughly 50-basis point spread over sovereign notes, strategist Rohit Arora wrote in an October 8 report. (Nupur Acharya/Bloomberg)

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

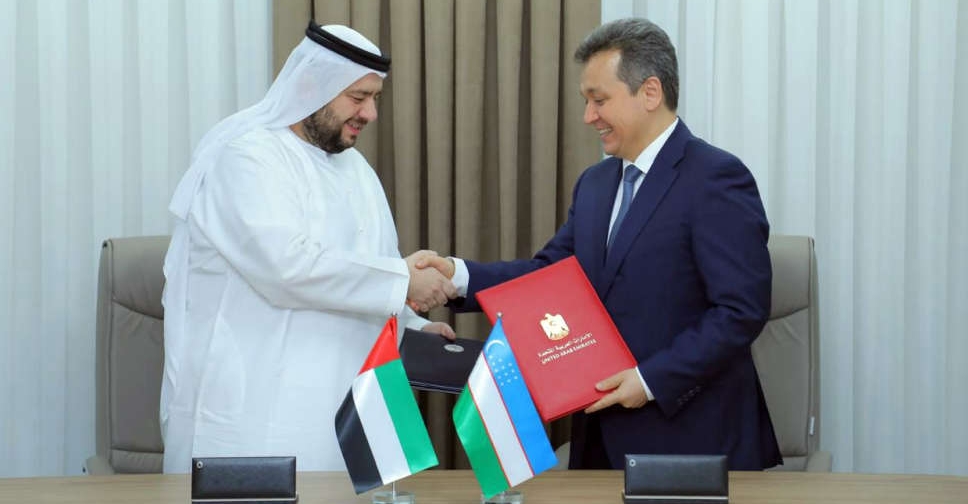

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors