The European Commission has ruled that Ireland must recover up to AED 52 billion in back taxes from Apple. After a three year long investigation they concluded that the US firm’s tax benefits were illegal. The Commission said Apple was coughing up substantially less than other businesses, in effect paying a corporate tax rate of 1%. Ireland has responded saying they profoundly disagree with the ruling.

Indian rupee, stocks soar in relief rally after trade deal with US

Indian rupee, stocks soar in relief rally after trade deal with US

UAE, DR Congo sign CEPA to strengthen economic partnership

UAE, DR Congo sign CEPA to strengthen economic partnership

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

'World's Coolest Winter' boosts UAE tourism, hotel revenues hit AED 12.5 billion

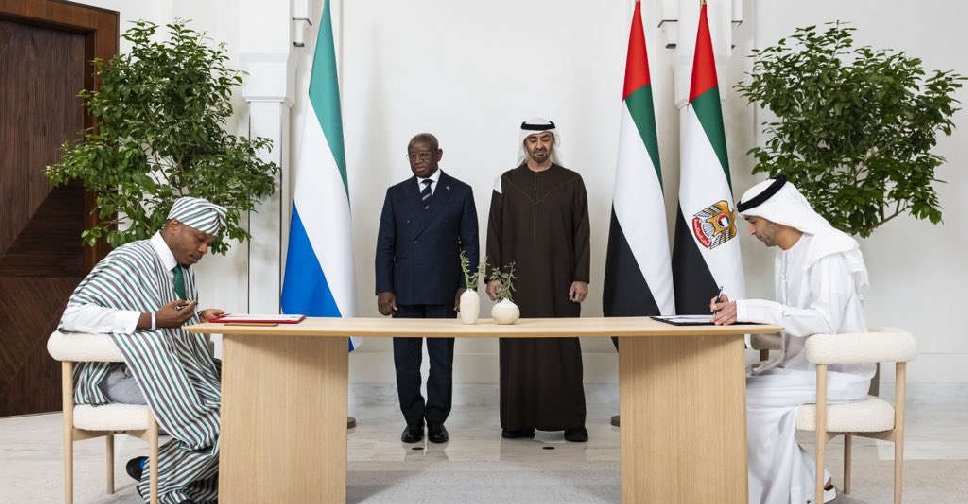

UAE and Sierra Leone sign major trade pact

UAE and Sierra Leone sign major trade pact

IMF chief praises UAE's model of economic diversification

IMF chief praises UAE's model of economic diversification