A United Arab Emirates-based investor group led by Emaar Properties PJSC Chairman Mohamed Alabbar said it agreed to buy Kuwait Food Co. shares from its majority stockholder for $2.36 billion. Adeptio AD Investments SPC Ltd., the group led by Alabbar, will pay 2.65 Kuwaiti dinars ($8.80) per share to buy a stake in the company known as Americana from Al Khair National for Stocks and Real Estate Co., the companies said in a statement. That represents a 26 percent premium to the last closing price on Wednesday in a sales process that has stretched back at least two years. Adeptio will launch a mandatory takeover offer for the remaining shares of Americana at the same price, according to the statement. Al Khair owns a 67 percent stake in the company that operates KFC and Pizza Hut restaurants in the Middle East and North Africa, according to data compiled by Bloomberg. Throughout the years, suitors have included Singapore’s Temasek Holdings Pte, KKR & Co. and CVC Capital Partners Ltd. The shares of Americana have gained 5 percent this year to 2.1 dinars, while Kuwait’s benchmark stock index has declined 3.9 percent. “We are delighted to have acquired one of the crown jewels of the Middle East,” Alabbar said in the statement. “With its long and successful history as the leading food and restaurants business in MENA, Americana is uniquely positioned in the region.” Adeptio hired Goldman Sachs Group Inc. for advice on the transaction, as well as Allen & Overy as its lawyers. Rothschild advised Al Khair, which sought legal counsel from Clifford Chance. Standard Chartered Bank assisted in structuring the acquisition financing and joined Credit Suisse, Ahli United Bank, Emirates NBD, First Gulf Bank and National Bank of Abu Dhabi as mandated lead arrangers for the transaction. By Sonali Basak/Bloomberg

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

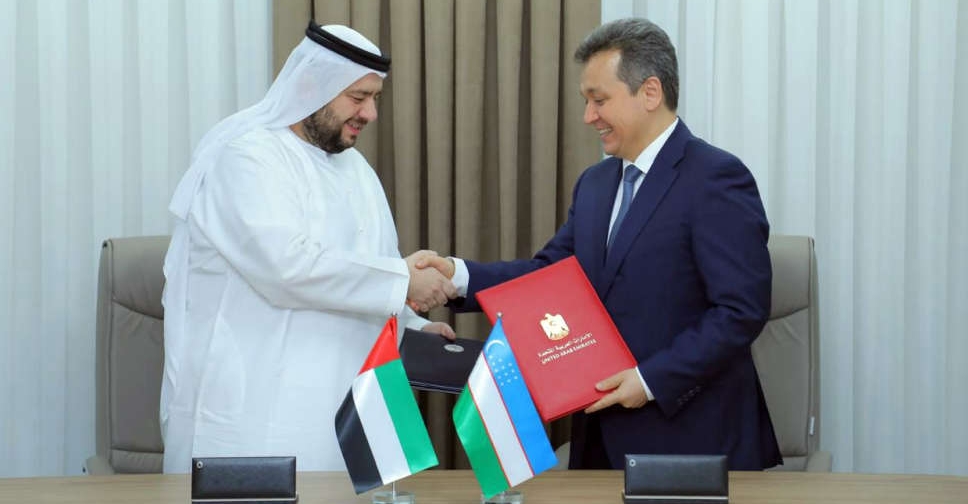

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors