ADNOC Distribution released strong Q1 2024 financial results, showing an 18 per cent year-on-year increase in EBITDA to $248 million.

The growth aligns with its new five-year strategy, focusing on domestic expansion, international platforms, and future-proofing.

The company's AI initiatives, like Fill and Go, contributed to this progress.

Despite UAE Corporate Tax impact, net profit rose to $150 million, excluding tax, a 13 per cent increase. Fuel volumes surged by 17 per cent, with eight new stations opened.

Non-fuel retail transactions increased by 7 per cent, and plans include expanding car wash facilities and F&B brands. AI-driven operational enhancements improved efficiency, reducing emissions and enhancing fuel delivery accuracy.

Bader Saeed Al Lamki, CEO of ADNOC Distribution, said the figures "are a testament to the Company's five-year strategy announced earlier this year, which prioritises domestic growth, international platforms, and future-proofing the business.

"We are well positioned to achieve our operational objectives for 2028, aiming to expand the ADNOC Distribution network to 1,000 stations, increase the number of fast and super-fast EV charging points to at least 500, grow our non-fuel transactions by 50 per cent, and increase the number of convenience stores by 25 per cent."

Expansion in EV charging points marked a 68 per cent increase, with plans to double by 2024-end.

ADNOC Distribution's disciplined growth strategy, with significant investments and shareholder-friendly policies, aims to sustain shareholder value and returns amid ambitious growth projects.

ADNOC Drilling awarded AED6.24bn contract to unlock UAE’s unconventional energy resources

ADNOC Drilling awarded AED6.24bn contract to unlock UAE’s unconventional energy resources

EHRDC offer 50 private-sector job opportunities for Emiratis

EHRDC offer 50 private-sector job opportunities for Emiratis

Tokyo startup to develop reusable rocket

Tokyo startup to develop reusable rocket

OpenAI strikes deal to bring Reddit content to ChatGPT

OpenAI strikes deal to bring Reddit content to ChatGPT

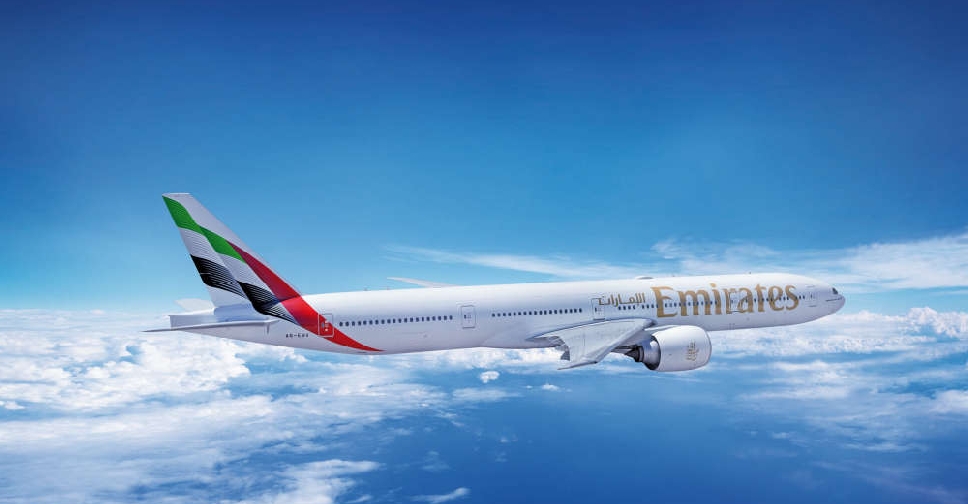

Emirates set to resume Nigeria flights

Emirates set to resume Nigeria flights